Whether you work for a dance center, company, or arts education organization, understanding the varied sources of income at your place of work provides valuable information and context. Considering the past, present, and future finances gives you a window into the stability of your organization and where priorities must be in terms of the administrative team's work each week.

Some of this information might be easily accessible to you as an employee, or you might need to consult your supervisor to find out more.

Some initial ideas include:

-Do you work at an arts education organization? What percentage of income comes from grants, versus income from schools and students paying for the dance classes and residencies?

-Do you work for a dance company? How dependent are you on the income earned from ticket sales?

-Do you work at a dance studio? What amount of income comes from youth classes, versus the adult program?

Restricted Funds/Unrestricted Funds

"Restricted" funds – whether a grant or donation – means that the money must be used for a specific project. For example, a foundation may have given your dance company $50,000 for dance classes in the local public school district. Even if your dance company could use that money to support its next production, the money cannot be used for that task. Most grants require a report afterwards to specifically describe how the funds were used.

Unrestricted funds – including many donations from individual donors – means income that can be used by your organization in the way that you best see it being used. A donor might have just given your dance center $10,000. That money could help pay for your roof repair, set up a scholarship fund, or purchase new marley for a studio.

Funding Cycles

If your organization receives major funding from a foundation, arts council, or the NEA – find out if it is for just this year, or if funding is secured for the next few years (such as 3 years in a row). A word of caution and a heads up – your organization might receive major funding for a few years, and then you might be ineligible for that particular grant for the following few years. Knowing these details can really help with long-term planning and programming.

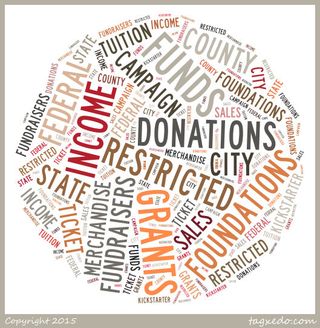

Income Sources

The many sources of income for dance organizations includes:

-Tuition: Youth classes

-Tuition: Adult classes

-Tuition: Summer camps

-Guest speaking fees

-Fee for service (teaching in a K-12 school, performing at an assembly)

-Merchandise (t-shirts, bags, videos)

-Ticket sales

-Individual donations (direct ask letters, "donate now" button on your website)

-Kickstarter and Indiegogo campaigns

-City/county/state grants

-Federal grants

-Foundation grants

-Fundraisers (galas, online silent auctions)

-Money already in your organization's checking account

-Money already in your organization's savings account

Non-profits and Earning Income

Each year, an organization needs to set goals around income/expenses. The budget will be closely reviewed and then approved by the board of directors. The organization might want to break even, might lose money for a year (if investing in certain programs, initiatives, or buildings), or an organization might earn income.

It is a common misconception that a non-profit cannot earn income. Non-profits must be strategic about earning income and building a reserve as they plan for future projects and also have a savings account to support the organization with cash flow in the future.

—————————-

Leave a comment